Divrsity solves your FCA/PRA Diversity & Inclusion Data Collection, Reporting, and Disclosure Requirements

27th November 2023 by Mark Holt

Divrsity has been running Diversity & Inclusion Surveys for many years, and we are big believers in using Data to drive improvements in D&I.

So we were excited to see the recent consultation by the FCA/PRA that proposes mandatory reporting for regulated financial services organisations with more than 250 employees.

We have translated the proposed FCA/PRA question set into the Divrsity platform, so are pleased to announce that Divrsity offers a low-cost (less than £1,500 for organisations up to 20,000 employees) way for regulated organisations to fulfil all their FCA/PRA Diversity & Inclusion data collection, reporting and disclosure requirements.

Background

In September'23, the Financial Services financial regulators set out proposals to "boost diversity and inclusion to support healthy work cultures, reduce groupthink and unlock talent". Learn More

From the FCA/PRA press release: The proposals set flexible, proportionate minimum standards to raise the bar, placing more requirements on larger firms. Proposals set out for firms include requirements to:

- Develop a diversity and inclusion strategy setting out how the firm will meet their objectives and goals.

- Collect, report and disclose data against certain characteristics.

- Set targets to address under-representation.

Based on the requirements in the FCA/PRA consultation, Divrsity now enables organisations to fulfil their all their requirements for D&I data collection, reporting and disclosure.

Data Collection

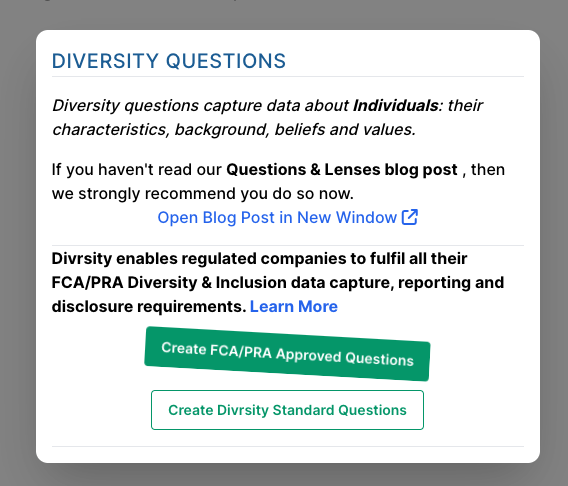

In addition to our constantly-evolving expert-approved questions, the Diversity survey platform has always allowed customers to create and manage their own custom question sets.

Customers that select as being in the "Banking / Insurance / Finance" industry are offered the ability to use the FCA/PRA Diversity & Inclusion questions and lenses.

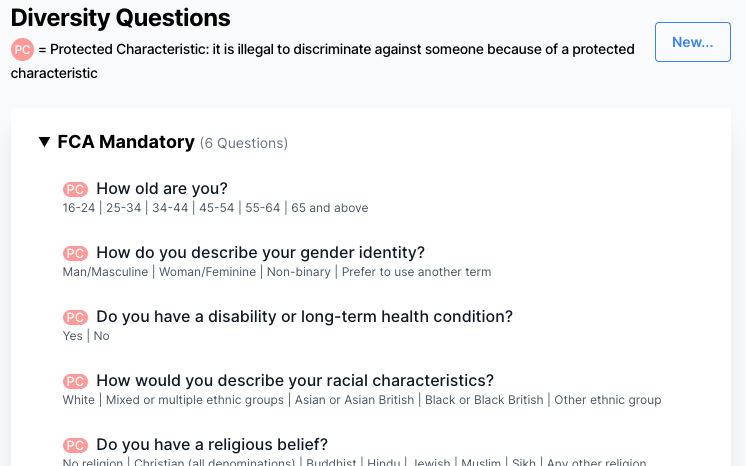

This generates the FCA/PRA mandatory and voluntary question sets, along with a few Divrsity recommended questions (marital status, neurodiversity etc)

Our existing Lenses capability is used to enable organisations to filter the data by Board, Senior Leadership and Employees; as required by the proposed legislation.

Within 5 minutes of the survey completing, customers can use the normal Divrsity tooling that enables organisations to view their results, slice-and-dice the the data, and export to Excel.

Once the FCA RegData system has been updated to accept submissions of D&I data, we will generate a compatible XML/XBRL file that can be uploaded. This is not obviously available today but we guarantee to provide a compliant solution within 14 days of the specification being available.

Next Steps

If you are a financial services organisation that is wondering how the new Diversity & Inclusion reporting requirements will impact you, why not sign up to the platform. Many organisations will benefit from gaining some experience with Diversity & Inclusion questions before the regulatory requirement comes in.

More Blog Articles

- Learn about best-in-class comms strategy to help you get high response rates

- See how we use AI to generate deeper insights

- Learn why we created Divrsity

- Understand how Lenses help you create an inclusive company

- Or explore one of the articles in our Diversity Dictionary Series:

Intersectionality,

Ableism, and

Transgender